Investing in gold can be a prudent decision to diversify your portfolio and protect your wealth against inflation. However, there are two primary approaches to invest in this precious metal: a Gold IRA or physical gold. Both offer distinct benefits, but which is the right choice for you? A Gold IRA allows you to acquire gold inside an Individual Retirement Account, offering tax benefits. Physical gold, on the other hand, refers to holding actual coins which can be maintained in a safe deposit box or at home.

Before making a decision, it's crucial to thoroughly consider your financial goals. A Gold IRA might be ideal if you seek tax advantages and long-term growth of your retirement savings. Physical gold, however, may appeal to investors who emphasize real assets and choose greater custody over their investments.

- Assess your risk aversion

- Establish your investment timeframe

- Investigate different gold IRA providers

Ultimately, the best choice for you depends on your individual needs. Consulting with a experienced expert can provide personalized recommendations to help you make an informed decision.

Gold IRA vs. 401(k): A Comparison for Retirement Planning

Deciding on the best retirement savings strategy can feel overwhelming. Two popular options are the Gold IRA and the traditional employer-sponsored plan. Each provides unique strengths and limitations. A IRA invested in precious metals allows you to allocate your portfolio by investing in physical gold, which can potentially hedge against economic uncertainty. Conversely, a 401(k) is a tax-advantaged account that facilitates contributions from both you and your employer.

- Considerations to analyze when making this selection:

- Portfolio diversification

- Retirement needs

- Contribution limits

Consulting with a financial advisor can guide you in making an informed choice that aligns with your specific circumstances and retirement goals.

Exploring a Gold IRA: Weighing the Advantages and Drawbacks

A Gold Individual Retirement Account (IRA) presents a compelling opportunity for investors seeking to diversify their portfolios and potentially protect against economic instability. Gold, historically viewed as a secure haven asset, can possibly maintain its value during unpredictable market conditions. However, it's important to meticulously assess both the advantages and drawbacks before contributing your retirement savings.

- Growth potential in precious metals value

- Reduced risk through diversification

- Inflation hedge

However, a Gold IRA involves some considerations to carefully ponder. For starters, gold doesn't generate yield, unlike stocks or bonds. Moreover, storage and insurance expenses can accumulate. Finally, the ability to sell quickly of gold can be challenging compared to other investment alternatives.

Top-Rated Gold IRAs in 2023: Expert Reviews and Comparisons

Navigating the world of retirement can be challenging, especially when considering alternative assets like gold. A Bullion IRA offers a unique opportunity to diversify by allocating a portion of your retirement savings to physical gold. To check here help you make an informed decision, we've researched the best Gold IRAs available in 2023, offering detailed comparisons and expert insights.

- Explore factors such as fees, opening requirements, reputation, and the variety of investment options offered.

- Each provider on our list undergoes rigorous vetting to ensure reliability.

- Our comparisons aim to simplify the process of choosing a Gold IRA, empowering you to make the most suitable choice for your investment strategy.

Unveil The Ultimate Guide to Investing in a Gold IRA

A Gold Individual Retirement Account enables you to diversify your retirement portfolio with physical gold. This strategic investment option offers several promising benefits, including protection against rising costs. To get started with a Gold IRA, you'll need to select a trustworthy company that specializes in these types of accounts.

- Evaluate the expenses associated with each custodian carefully.

- Comprehend the different types of gold investments available, such as coins.

- Speak to with a financial professional to evaluate if a Gold IRA is right for your individual circumstances.

Remember, diligently researching and planning are essential steps prior to making any decisions.

Is Gold IRA Worth It? Understanding the Risks and Rewards

A Gold Individual Retirement Account (IRA) presents a alternative way to invest your retirement funds. Many investors are attracted by gold as a safe haven inflation and financial instability. However, it's crucial to completely understand both the benefits and the risks before diving in.

- Gold IRAs present potential profits over the long term, in times of financial instability

- Balancing your portfolio with gold may help mitigate losses in other asset classes

- Keep in mind, gold prices can be fluctuating and there is no guarantee of returns

When considering a Gold IRA, it's strongly advised to consult with a financial advisor

Marla Sokoloff Then & Now!

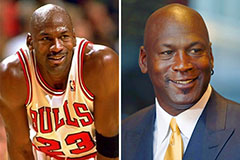

Marla Sokoloff Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!